The activity-based depreciation method considers the number of units or the output from the asset. To introduce the concept of the units-of-activity method, let’s assume that a service business purchases unique equipment at a cost of $20,000. Over the equipment’s useful life, the business estimates that the equipment will produce 5,000 valuable items. Assuming there is no salvage value for the equipment, the business will report $4 ($20,000/5,000 items) of depreciation expense for each item produced. If 80 items were produced during the first month of the equipment’s use, the depreciation expense for the month will be $320 (80 items X $4).

Summary Of Depreciation Methods

So we are getting pretty close to running out of miles here in our estimated useful life. So let’s go ahead and remember, this estimated useful life, it’s just an estimate. So we just wanna make sure that we depreciate only over that estimate that we made.

Formula for the Unit of Production Method

This means that the costs are assigned to the activities based on their usage or consumption. The activity depreciation method is used to allocate the depreciation expense base on the production activity. This method is designed to better match the costs with the revenue generated by the output.

What is Unit of Production Depreciation?

Hence, nursing activities assessed with TISS-28 may not be accurately evaluated. To reduce potential inaccuracies in assessment, Miranda et al. introduced modifications to TISS-28, leading to the creation of the Nursing Activities Score (NAS) (see Appendix 1). NAS encompasses 80.8% of all nursing activities, surpassing the 43.3% coverage of TISS-28 [13]. In contrast, neither the TISS-28 nor the NAS despite their recognized high reliability and sensitivity in measuring nursing workload have been validated for the Turkish setting.

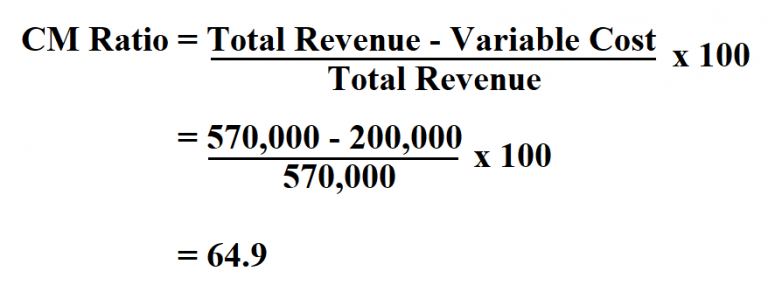

Or if it’s a machine that’s producing units, how much depreciation per unit it produces. In our numerator, we have cost minus residual value and remember this is our depreciable base. So this is the total amount of depreciation that we’re going to take over the useful life, right?

- Under the units of production method, depreciation during a given year will be greater when there is a higher volume of activity.

- Straight-Line Depreciation is the most common method of depreciation, and it is the easiest to calculate.

- However, the amount of depreciation expense in any year depends on the number of images.

- We then multiply the resultant number with the production of that year to get the depreciation for that particular year.

Examples include factories using equipment that wears down with usage or vehicle fleets where mileage directly affects depreciation. By aligning depreciation with usage, companies can better match the cost of the asset to its contribution to revenue, thereby enhancing accuracy in financial reporting. Using the actual miles, we multiply by the factor to determine depreciation expense. Net Book Value is calculated by taking the cost of the asset and subtracted the accumulated depreciation. The objective of this study was to assess the Turkish validity and applicability of the model, taking into account the capacity of NAS to gauge nursing workload in intensive care units.

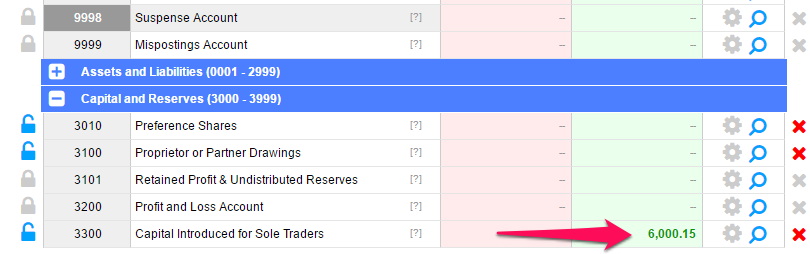

However, the depreciation will stop when the asset’s book value is equal to the estimated salvage value. It would be hard to apply this method to depreciate office buildings or other revolving funds for financing water and wastewater projects assets that are not linked with the production unit. Accruing tax liabilities in accounting involves recognizing and recording taxes that a company owes but has not yet paid.

Consider the following example to more easily understand the concept of the sum-of-the-years-digits depreciation method. It is because, in the real world, a manufacturing company has several assets that help to make one product. In other words, it is the reduction in the value of an asset that occurs over time due to usage, wear and tear, or obsolescence. The four main depreciation methods mentioned above are explained in detail below.

The activity-based depreciation method takes a contradictory approach from other methods of depreciation. It focuses on the usefulness of the asset rather than spreading the costs of assets over time. Large and tangible assets such as plants and machinery go through cyclic lives with fluctuating usage. The activity-based depreciation allows businesses to match these higher costs against the usage level of the asset. So whenever we calculate depreciation in all the different methods, we’re always going to be concerned about 3 variables. The initial cost of the asset, then we’re going to have to estimate a useful life and this is how long the company expects the asset to help us generate revenue.